How To Find A Paypal Forex Broker?

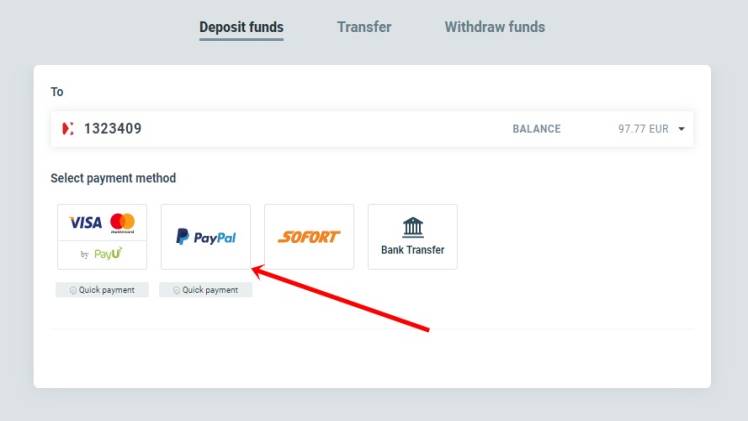

When you first register with a Paypal forex broker, you will be asked to provide proof of identity and address, as well as an amount of funds to deposit into your forex trading account. This information is used to ensure that you are the true owner of the account. You can use a bank statement, utility bill, or tax statement to verify your details. In most cases, a forex broker that accepts PayPal will offer this service through their payment portal. Look for a PayPal logo on the broker’s website and all payment pages. If you don’t find the PayPal logo, contact the broker’s support team to make sure that the payment method is available. A PayPal forex broker should also offer you the option to withdraw funds, as long as you have verified your identity.

Most brokers will accept PayPal with paypal forex broker, though some may not advertise it. The customer support team should be able to explain if the broker accepts PayPal before deciding to sign up. The amount of money you can deposit will depend on the broker, as some may charge higher fees for this payment method, while others will set a low minimum deposit limit for it. PayPal is a safe way to make payments, as it doesn’t require credit card numbers. In addition, if something goes wrong, PayPal will refund your money. Then, when you want to withdraw your money, PayPal is extremely fast. If you’re looking for a trustworthy online broker, there are some things to consider before making a deposit with eToro. First of all, you should be aware of the risks involved in trading. Leveraged trading involves risking more money than is necessary. In other words, it can put you at risk of losing more than your initial deposit.

If you’re new to trading, eToro has a virtual portfolio feature that’s perfect for novice investors. The platform will give you up to $100,000 in virtual money to trade with. This feature allows you to test different trading strategies before investing real money. If you’re not sure how the system works, there are also plenty of eToro reviews available online. eToro allows users to trade with hundreds of financial assets, including stocks and ETFs. In addition, it features a social community that lets you learn from experienced traders. Moreover, the platform offers 0% commission fees on real stocks. Still, it’s important to remember that eToro comes with a high risk of losing money. Consequently, you should be wary of this company.

The etoro review uk has a proprietary trading platform that is easy to use. It also allows you to copy the trading strategies of a professional trader. In addition, eToro offers investor protection for UK clients, up to PS85,000 in case of a problem. The eToro platform offers a free trial account for new users, which gives them the opportunity to analyze their trading results and choose any currency they’d like to use. The trial account does not allow financing based on trading results, however. The eToro software tracks every trade you make, so you can monitor your trading performance in real time. It also tracks the size of your account, starting and ending dates, and the platform you chose.

Before opening an account, you must complete a trading challenge worth at least $300,000. If you succeed in this challenge, you will receive seventy percent of your profit. After you complete this challenge, you must repeat the process a few times before you start earning your first profit. Then, eToro will provide you with an extensive trading journal and account analysis. These tools will help you learn how to trade in the forex market.